ARTICLE OF INCORPORATION

OF

ROTARY

FOUNDATION OF BEAVERCREEK

The undersigned, desiring to form a corporation not for profit under Section 1702.01 et seq., Revised Code of Ohio, do hereby certify:

FIRST The name of said Corporation shall be ROTARY FOUNDATION OF

BEAVERCREEK.

SECOND

The place in Ohio were the principal office of the Corporation is to be

located is 26 North Wright Avenue, Fairborn, Greene County, Ohio 45324.

THIRD The specific and primary purpose for which this Corporation

is organized is exclusively for charitable, religious, educational, and

scientific purposes, including, for such purposes, the making of distributions

to organizations that quality as exempt organizations under Section 501(c)(3)

of the Internal Revenue Code, or corresponding Section of any future Federal

Tax Code.

No part of the net earnings of the

Corporation shall inure to the benefit, or be distributable to its members,

trustees, officers, or other private persons, except that the Corporation shall

be authorized and empowered to pay reasonable compensation for services

rendered and to make payments and distributions in furtherance of the purposes

set forth in the purpose clause hereof.

No substantial part of the activities of the Corporation shall be the

carrying on of propaganda, or otherwise attempting to influence legislation,

and the organization shall not participate in, or intervene in (including the

publishing or distribution of statement(s) any political campaign on behalf of

any candidate for public office.

Notwithstanding any other provision of this document, the corporation

shall not carry on any other activities not permitted to be carried on (a) by

an organization exempt from federal income tax under Section 501(c)(3) of the

Internal Revenue Code, corresponding Section of any future Federal Tax Code, or

(b) by an organization, contributions to which are deductible under Section

170(c)(2) of the Internal Revenue Code, or corresponding Section of any future

Federal Tax Code.

Upon the dissolution of the Corporation,

assets shall be distributed to one or more exempt purposes within the meaning

of Section 501(c)(3) of the Internal Revenue Code, or corresponding Section of

any future Federal Tax Code, or shall be distributed to the Federal Government,

or to a state or local government, for a public purpose. Any such assets not disposed of shall be

disposed of by the Court of Common Pleas of the county in which the principal

office of the Corporation is then located, exclusively for such purposes or to

such organizations as said Court shall determine, which are organized and

operating exclusively for such purposes.

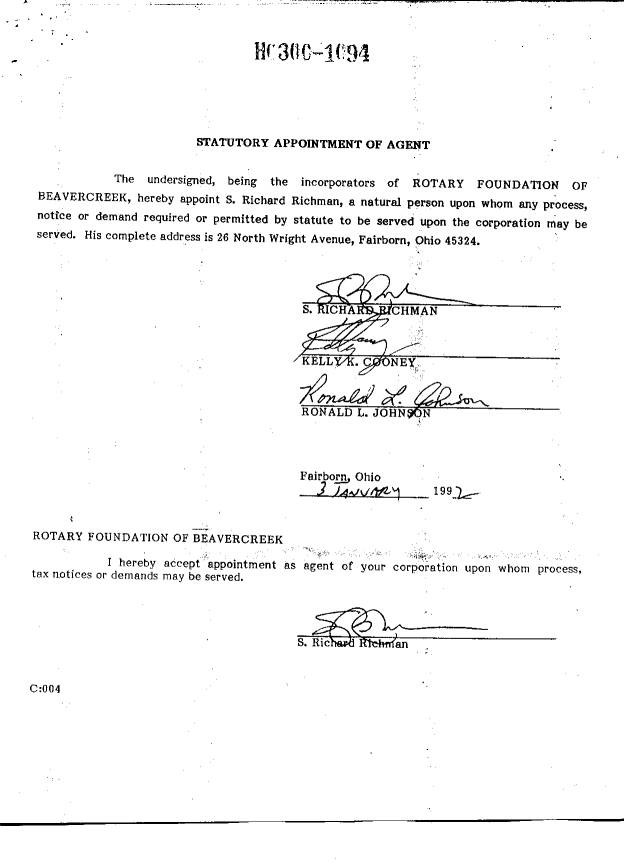

FOURTH The names and addresses of the persons who are to be the

initial Trustees of the Corporation are as follows:

S.

Richard Richman 26 North

Wright Avenue

Fairborn,

Ohio 45324

Kelly

K. Cooney 920 Pimlico

Drive, Apt. 313

Centerville,

Ohio 45459

Ronald

L. Johnson 2560 Kenmont

Court

Beavercreek,

Ohio 45434

FIFTH The

membership of this Corporation at all times shall consist of the Trustees.

SIXTH These

Articles may be amended in any respect which does not alter the charitable

nature of the Corporation or permit or authorize the distribution of its income

or property for other than charitable purposes by a two-thirds (2/3) vote of

the members at a meeting duly called and held for that purpose.

SEVENTH

In the event of the dissolution of the Corporation, after the

payment of all of its obligations, all its income and property shall be applied

solely for the charitable purposes for which the Corporation was formed.

IN WITNESS WHEREOF, we have hereunto

subscribed our names this _____ day of ______________, 1992__.

//SIGNED// .

S.

RICHARD BICHMAN

//SIGNED// .

KELLY

K. COONEY

//SIGNED// .

RONALD

L. JOHNSON